An Intro to Elliot Wave Theory

Figure A

Elliot Wave Theory is a form of technical analysis that is used by traders to forecast asset prices. Elliot Wave Theory highlights extremes in trends by identifying market psychology and price levels. This article will discuss how Elliot Wave Theory may help you make a better judgment when investing in assets.

Content:

General Information-

What is Elliot Wave Theory?

Psychology of Elliot Wave Theory

Motive and Correctional Waves

Advanced Ways Investors use Elliot Wave Theory

Conclusion

1. What is Elliot Wave Theory

Elliot Wave Theory is a strategy used by traders and is a form of technical analysis. The theory was named after Ralph Nelson Elliot who discovered that the stock market moves in waves during the 1930s. The theory is made up of motive waves and various corrective waves that all resemble different characteristics. Elliot Wave Theory revolves around three rules that can’t be broken. (1) Wave 2 cannot retrace past Wave 1 (2) Wave 3 cannot be the shortest compared to Wave 1, and 3 (3) Wave 4 should not overlap Wave 1 region.

Figure B

2. Psychology of Elliot Wave Theory

Elliot Wave Theory does a great job displaying human emotions in the form of waves. Wave 1’s typically have pessimism and are often ignored but market makers set the bottom by accumulating. Wave 3 leads with optimism and gains the most attention because it's usually the strongest move on the chart. Wave 3’s is also where retail usually buy due to headlines, and media narratives. Wave 5’s ends in euphoria, which leads investors to think prices will keep on rising. Once the 5 motive waves are in, the bigger correction starts to play out in the form of an a-b-c subdivision. Wave A, is the bigger correction starting to play out which is when the tides turn to the downside. Wave A is when investors think, that the drop is a pullback. Wave B is a dead-cat bounce but the average investor will think it's getting ready to go back to new highs. Finally, Wave C comes into place where the market trends to new lows setting investors' emotions into depression where they capitulate. Once a full cycle is completed, a new wave follows it as per figure A.

Figure C

3. Motive and Correctional Waves

Elliot Wave has two different types of wave structures. One is known as Motive Waves and the other is known as Corrective Waves. Motive waves usually trend in a direction while correctional waves tend to go sideways. To get into more detail, Motive Waves have different forms like impulses, leading diagonal, and ending diagonal structures. Corrective waves also have different forms like flats, triangles, zigzags, double zigzags, and more. Each type of wave displays a different set of emotions that the market represents.

Figure D

4. Advanced Ways Investors use Elliot Wave Theory

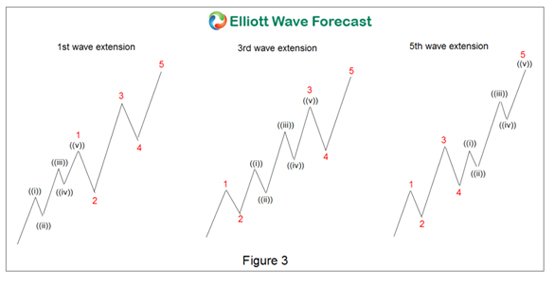

Elliot Wave Theory just like any other form of technical analysis may be complemented by other indicators. The most common tool used alongside Elliot Wave’s is Fibonacci extensions and retracements. Fibonacci retracement tools are used to determine how strong a trend may be. The less a motive wave retraces the stronger the move following it, will be. Fibonacci extension tools are used to calculate the distance at which a wave may end. In a 5 waves sequence, usually one of the waves has an extension. Using the Fibonacci tools, traders may calculate the distance of each wave to forecast where a wave may end. We barely scratched the surface, however, Fibonacci tools are very commonly used with Elliot Wave. Some example images are shared below.

Conclusion

Elliot Wave Theory is a complex tool that is used by many well-known traders. It’s also been around for almost 100 years, giving it a staple of approval for technical analysis. Elliot Wave traders have an advantage because they look at the market not only for its price but the psychological aspect as well. This gives most Elliot Wave traders a higher probability of being successful when it comes to trading since they may* have an edge when investing. Another thing to take note of is the complexity of Elliot Wave. One must dedicate time to learning the core elements and back-test them in the market to fully grasp the theory. With all of that being said, Elliot Wave is a phenomenal tool when used properly. (It is important to note that like anything else, no form of technical analysis is perfect)